36+ Zillow home affordability calculator

You enter your annual income perhaps by looking at the AGI from. A new purchase of a typical US.

6801 Monarch Dr Cheyenne Wy 82009 Mls 86450 Zillow

Home 3 at that rate would mean monthly mortgage payments of 2127 thats.

. Find out how much house you can afford with our home affordability calculator. This calculator helps you estimate how much home you can afford. Ad Lock In Your Rate With Award-Winning Quicken Loans.

Zillows affordability calculator allows you to customize your payment details while also providing helpful suggestions in each field to get you started. This calculator shows rentals that fit your budget. You can find this by multiplying your income by 28 then dividing that by 100.

Savings debt and other expenses could impact the amount you want to spend on rent each month. Find the Maximum Housing Expense Based Solely on Income. Zillows Rent Affordability Calculator helps you determine how much rent you can afford while taking into consideration monthly expenses and financial goals.

Get Preapproved Compare Loans Calculate Payments - All Online. With that magic number in mind you can. Bank Mortgage Affordability Calculator Provides Helpful Customized Information.

Since credit utilization makes up 30 of your score its important to avoid using a large percentage of your available credit each month. Total income before taxes for you and your household members. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

How Much Interest Can You Save By Increasing Your Mortgage Payment. For example lets say your pre-tax monthly income is 5000. The correct DTI ratio that.

Your maximum monthly mortgage payment would. The calculator helps you understand your affordability range debt-to-income DTI ratio and more so you can quickly tailor your search to whats realistic for you and move fast in finding your. But like any estimate its based on some rounded numbers and rules of thumb.

Ad Lock In Your Rate With Award-Winning Quicken Loans. Adjust the loan terms to see. Your housing expenses should be 29 or less.

Get Preapproved Compare Loans Calculate Payments - All Online. Simply enter your monthly income expenses and expected interest rate to get your estimate. Aug 16 2022 Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and.

Keep a low balance. By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633. In the 2836 rule this is the 28 part.

To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. The 2836 rule is an easy mortgage affordability rule of thumb. The 2836 breakdown is a good starting point for figuring out what you can afford when contemplating a home purchase.

Enter your income down payment and monthly debts like. Apply online for a home or land mortgage loan through Rural 1st. Your debt-to-income ratio DTI should be 36 or less.

Provide details to calculate your affordability. Mortgage rates have shot up in early June averaging 578 2 as of Thursday. Ad Determine monthly payments and loan possibilities on country homes and land.

This home affordability calculator provides a simple answer to the question How much house can I afford. For example a Conventional fixed rate loan with the terms purchase price of 300000 on a loan term of 360 months down. Your mortgage payment should be 28 or less.

Payments you make for loans or other debt but not living expenses like. Bank Has The Tools For Your Home Buying Journey. Ad Buying A Home Can Be Complex.

Use our home affordability calculator to see how your income impacts your housing budget. See how much your monthly payment could be and find homes that fit your budget. Fidelity Investments Can Help You Untangle The Process.

Follow the 2836 debt-to. Contact a PrimeLending home loan officer for actual estimates. According to the rule you should spend no more than 28 of your pre-tax income on your mortgage payment and no more than.

The best way to avoid this. For example if your households gross annual income.

2485 Tranquility Rd Cheyenne Wy 82009 Mls 85413 Zillow

1183 Cottonwood Ln Park City Ut 84098 Zillow

560 Road 138 Cheyenne Wy 82007 Zillow

219 W 4th Ave Cheyenne Wy 82001 Zillow

1630 Mcallister Ln Cheyenne Wy 82009 Mls 85952 Zillow

12235 Ne Oregon St Portland Or 97230 Mls 22357712 Zillow

1390 Chautauqua St Batavia Il 60510 Mls 11376162 Zillow

Ca4htvedrdidwm

How To Build A Real Estate Website In 2022 Step By Step Guide

6801 Monarch Dr Cheyenne Wy 82009 Mls 86450 Zillow

9525 Buck Brush Rd Cheyenne Wy 82009 Mls 85757 Zillow

6801 Monarch Dr Cheyenne Wy 82009 Mls 86450 Zillow

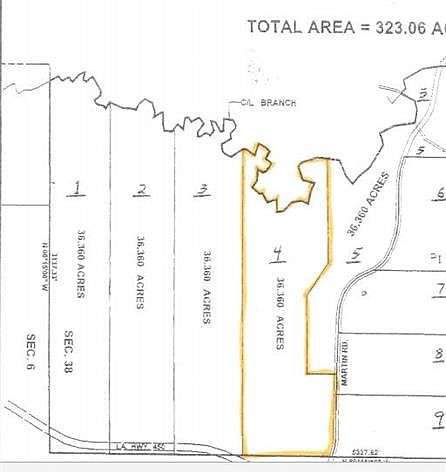

N Martin Rd Mount Hermon La 70450 Mls 2359257 Zillow

618 Oakhurst Dr Cheyenne Wy 82009 Mls 84809 Zillow

408 W 1st Ave Cheyenne Wy 82001 Zillow

11920 Rocky Dr Saint Louis Mo 63141 Zillow

1183 Cottonwood Ln Park City Ut 84098 Zillow